Agenda-setting intelligence, analysis and advice for the global fashion community.

For aspirational Millennial shoppers, a handbag was often their first significant luxury purchase. Now, Gen-Z is increasingly eyeing jewellery as its first big splurge and buying handbags secondhand.

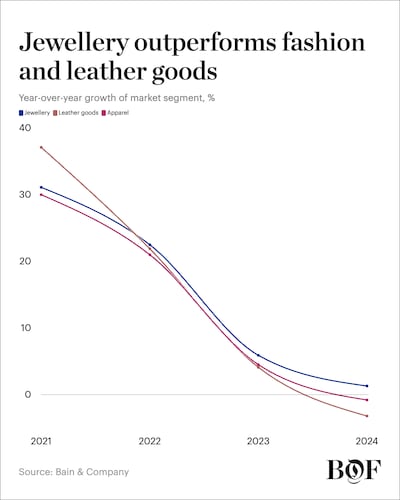

Jewellery is proving to be luxury’s most resilient category amidst a broader downturn that has seen even fashion and leather goods stalwarts like Chanel and LVMH report falling sales. Last year, while the luxury market as a whole declined 1 percent, jewellery still managed modest growth of as much as 2 percent, reaching €31 billion ($35 billion), according to Federica Levato, senior partner at Bain & Company. High jewellery performed particularly well.

Though still much larger, the market for leather goods, by contrast, shrank about 3 percent to €78 billion.

“We’re entering a trend of jewellery outperforming leather goods,” said UBS luxury analyst Zuzanna Pusz, who has been tracking the shift towards jewellery for years. “Jewellery is not making the mistakes fashion is making.”

ADVERTISEMENT

These mistakes include a lack of ingenuity as luxury fashion slumps under creative fatigue, quality concerns that are flooding social media — see the recent viral TikTok about Chanel’s footwear — and exaggerated price hikes that have prompted a shopper backlash.

Jewellery, by contrast, is nailing luxury’s values of quality, craftsmanship and customer service better than many fashion brands. The category’s resilience was evident in Richemont’s recent earnings, with the Swiss company’s jewellery sales soaring 11 percent in the quarter.

“The appeal of Richemont’s main jewellery brands, Cartier and Van Cleef & Arpels, remains clear and untarnished by the aggressive post-pandemic price increases implemented by other luxury brands,” wrote Bernstein analyst Luca Solca in a note following Richemont’s results.

But jewellery is facing challenges that could dim its lustre. The tariffs unleashed by US president Donald Trump have ushered in widespread economic uncertainty that threatens to dampen luxury sales further while simultaneously hitting European brands selling in the US with levies of up to 50 percent, according to Trump‘s most recent threats. The Chinese market also continues to lag, and jewellery makers are watching as prices for gold — one of their most important raw materials — skyrocket. Goldman Sachs analysts have forecast that gold prices will reach record highs this year as investors flock to it as a haven from economic volatility.

Even with these headwinds, however, jewellery still seems set to continue outshining fashion.

“I’ve been saying that jewellery will outperform fashion since 2022 and that won’t change anytime soon,” Pusz said.

Why Jewellery Feels More ‘Worth It’

One of the key reasons jewellery is gaining ground lies in its perceived value. As Pusz pointed out, fashion brands like Louis Vuitton and Chanel aggressively increased prices post-2020 — up to 10 percent or more — while jewellery brands like Cartier remained more restrained, with price hikes closer to 3 percent. As a result, a Cartier Love bracelet feels less expensive compared to a Chanel Classic Flap bag than it did a decade ago, suggesting a better price-to-value tradeoff in the minds of consumers.

Online chatter about the plunging quality of luxury bags, shoes and clothes hasn’t helped their value proposition. Social media is now flooded with complaints about deteriorating craftsmanship, particularly in leather goods. Chanel, once considered a paragon of craft, has been slammed with criticism for declining quality, even as prices climbed.

ADVERTISEMENT

Jewellery hasn’t received the same rebukes online. At the same time, the big names in luxury fashion have been criticised for backing away from creative experimentation, but that isn’t an issue jewellery is facing.

“There’s been much more innovation and variation in SKUs in jewellery, also at lower price points, allowing aspirational consumers to buy as well,” said Pusz.

This increased accessibility has unlocked a wave of younger buyers, particularly in China and Europe. It isn’t just women who are interested. More men are buying fine jewellery for themselves than in the past, opening up the category’s customer base.

“We noticed men purchasing more items like bracelets recently,” said Raphael Gübelin, president of Swiss jewellery brand Gübelin.

Tailwinds and Headwinds

The category has other winds blowing in its favour. Women’s earning power continues to grow, for instance, and over the years women have purchased more jewellery for themselves rather than waiting to receive it as a gift. It’s boosting both small and large names alike and sparking trends like jewellery stacking, layering, personalising and venturing into more playful options in terms of colour and shape.

Jewellery players aren’t sitting back and waiting for consumers to come to them, however. A number are investing in hyper-local marketing, like when Tiffany & Co. featured German actress Nilam Farooq, speaking in German, in the campaign for their store opening in Düsseldorf.

“That shows commitment to the cities they’re in, even when retail has struggled in the past. By investing and connecting locally, customers feel proud of their city being promoted by a jewellery brand with global recognition,” said Oisin James Deady, co-founder of creative agency Twelve AM that produced the Düsseldorf campaign and several other hyper-local promotional campaigns for Tiffany & Co. and other jewellery brands.

But the sector does face some challenges. The price of gold is up more than 25 percent since the start of the year, and, even if it hasn’t had a huge impact on prices on the consumer end yet, the surging cost may pressure margins.

ADVERTISEMENT

Still, Pusz notes that many brands — even Cartier — are exploring alternative materials like platinum, silver, and diamond-forward designs, noting that diamond and platinum prices have come down recently. Gübelin is similarly looking to options beyond gold.

“We have been much more experimental and creative with materials, like titanium, and are seeing a real surge in interest in colourful gemstones,” said Gübelin.

The Chinese customer is still a sore spot for luxury overall. Jewellery, however, is less affected than fashion-centric brands or heavily China-focused categories like watches. From a geographic standpoint, Richemont most recently saw double-digit growth across nearly all regions, even though Chinese demand is temporarily softer.

Perhaps more concerning for Switzerland-based Richemont are Donald Trump‘s fluctuating tariffs. Switzerland is currently subject to a 10 percent US tariff, but the levy could go up to 31 percent.

Richemont chief executive Johann Rupert has stated clearly, and repeatedly, that the company wants to avoid sharp price hikes. If jewellery is able to maintain its current pricing, it would help to further cement jewellery‘s value perception.

“I don’t believe you should only increase prices because you are a luxury brand,” Gübelin said. “You should fairly price your products. If prices go down, you should also adjust.”