Agenda-setting intelligence, analysis and advice for the global fashion community.

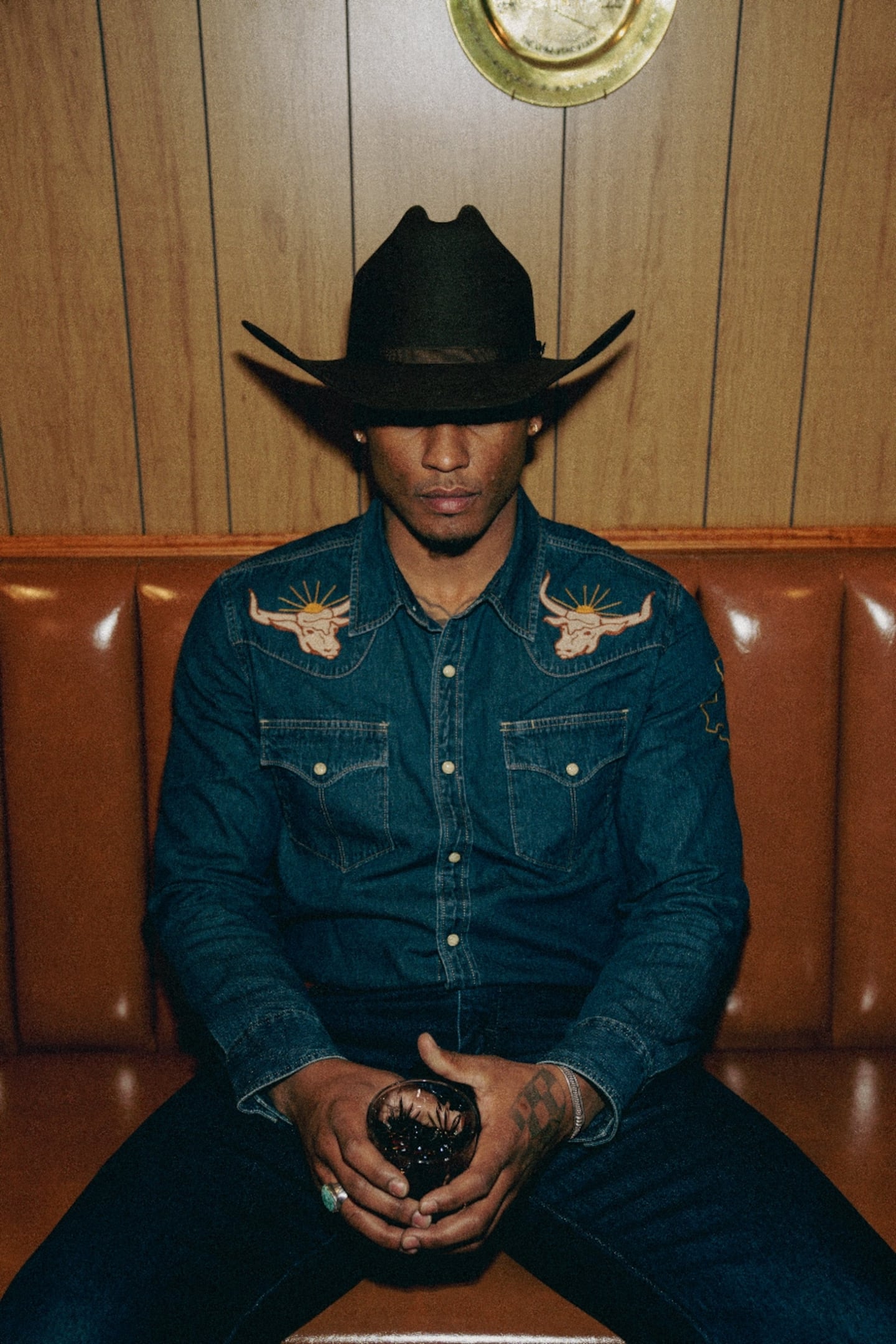

Tecovas is bringing its western appeal to the concrete jungle.

The 10-year-old digitally native brand, known for its $300 cowboy boots, is opening a 4,500-square-foot flagship store in SoHo this fall. The New York outpost is one of 12 new locations Tecovas plans to open in 2025, as part of a larger retail expansion that will bring its total store count up to 54 by the end of the year.

Plenty of digitally native brands have prioritised brick-and-mortar in recent years as online customer acquisition costs have risen. For Tecovas, however, it’s representative of not just a push offline, but into markets outside of the American South — home to most locations typically considered cowboy boot country.

Tecovas’ retail expansion has fuelled growth as it seeks to capitalise on a broader western wear trend, boosted by cultural moments like the hit TV series “Yellowstone” and Beyoncé’s Grammy-winning Cowboy Carter album. Last year, the brand opened 11 stores including Northeast locations like Boston and Philadelphia, and saw a total of 4 million visitors across its 42 stores, said David Lafitte, Tecovas’ president and chief executive. It expects those new stores to accelerate growth, with sales projected to rise 20 percent year over year to $300 million in 2025.

ADVERTISEMENT

To make its mark in New York, and achieve its growth goals in the process, Tecovas has to tailor its western wear proposition to a market where cowboy boots aren’t a staple and buzzy start-ups are opening retail locations every day. The New York store will feature classic SoHo architectural benchmarks, like exposed brick and high walls filled with custom art pieces. But it also will be filled with Tecovas’ retail signatures like a bar that serves complimentary cocktails, boot shining services and customisation stations where shoppers can embellish cowboy hats or monogram leather goods. The brand will host a slew of grand opening events that will include New York cultural staples such as serving guests coffee from local cafés.

“It’s important that we understand the nuances of local markets. But we also want to make sure we’ve got conviction behind who we are,” Lafitte said. “We’re going to bring authentic western Tecovas to SoHo, but we also want to recognize that we are in SoHo.”

Tecovas’ stores offer an opportunity to convince consumers that it is a true lifestyle brand. In recent years, Tecovas has beefed up its apparel offering, which consists of staples like jeans, t-shirts and shawl cardigans and accounted for 8 percent of sales in 2024, including adding items like dresses and denim skirts to its womenswear line last year. Specifically its New York location — by far its biggest at 4,500 square feet compared to its average store size of 2,500 square feet — gives the brand more space to showcase its entire assortment, Lafitte said.

Tecovas’ retail and product expansions are all in service of its goal of reaching $1 billion in annual revenue by 2030. But the brand isn’t sacrificing its bottom line to chase nine figure sales. It funded all new stores with the cash it generated from the business, Lafitte said. It also entered wholesale last year, where it grew its physical footprint without the costs of new stores, starting with western wear specialty boutiques like National Roper Supply, Texas Boot Company and Boots Etc. This year, Tecovas is entering bigger department stores, starting with Nordstrom this spring. The goal is to increase its margins on the basis of earnings before interest, taxes, depreciation and amortisation to as high as 20 percent in the coming years.

“It’s not an ambition of growth, for growth’s sake,” Lafitte said. “We want to build a meaningful, durable, long-term brand, and we want to do it in a controlled way.”

Editor’s Note: This article was amended on 5 March 2025 to correct the number of annual visitors to Tecovas stores.